About Unity FCS

Unity FCS is passionate about sharing over 30 years of FC expertise and knowledge, helping to protect you and ensure the growth and continued success of your business.

Unity FCS is passionate about sharing over 30 years of FC expertise and knowledge, helping to protect you and ensure the growth and continued success of your business.

Welcome to Unity FCS. We are dedicated to working in partnership with individuals and firms of all sizes, working within the Mortgage, Lending and Property Sectors. We want to share over 30 years of expertise and knowledge of financial crime risks, supporting a unified and proactive approach. Our aim is to help you keep safe, avoid serious issues and consequences, protect your reputation and support the growth and success of your business.

For those working within Financial Services, particularly in the Mortgage and Lending sectors, it is absolutely essential that you understand how to manage and mitigate AML and fraud risk effectively and protect everyone associated with you and your business.

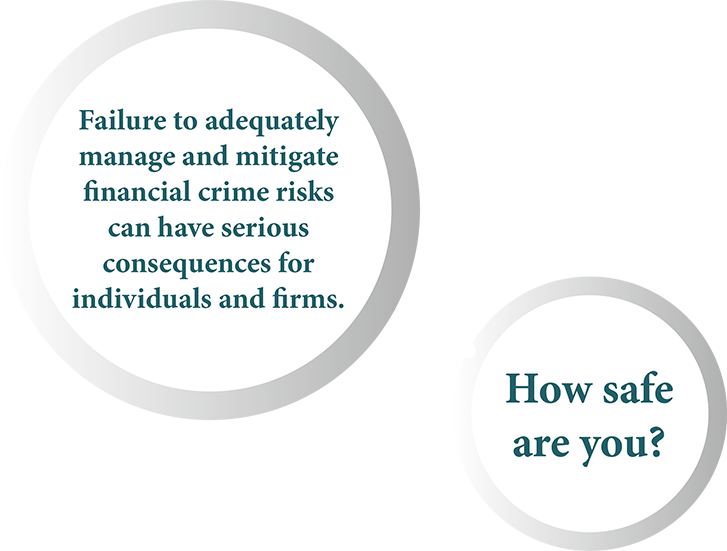

Failure to do so can lead to the following:

Very often issues arise due to lack of knowledge and understanding about the many risks out there, including new and emerging threats. Inadequate management of FC risks, such as weak controls, can allow fraudsters to exploit the vulnerability of firms and individuals.

As a subject matter expert in mortgage and lending FC risks, I have worked in partnership with Lending and Mortgage Teams, Lending Peers, FCA, Trade Bodies, Law Enforcement and the wider industry to improve controls and processes, mitigate risks and minimise losses, without losing sight of delivering excellent service and a positive customer journey.

I formed Unity FCS to be able to share this experience, expertise and knowledge with a wider audience, for those working on the frontline, such as mortgage advisers and lending and property professionals. Our aim is to provide relevant support and guidance, to help you have peace of mind that you are better protected and adequately managing financial crime risks and threats, avoiding distractions and issues, which can threaten your livelihood.

At Unity FCS we have a helpful and friendly approach, understanding risks relating to your business type, colleague roles, clients, services and products. We are happy to listen to your needs, devise and provide flexible support and consider varying requirements to suit your firm size, structure and budget. For example:

Delivering bespoke, interactive fraud and AML training, utilising real life case studies, false documents, insightful and engaging content. Meeting your needs and requirements through flexible delivery methods, workshops and bitesize sessions, using a variety of methods and channels.

Supporting you with lender panel removals and issues. Help you identify root cause and take remedial action where necessary. Assist with lender engagement to re build trust, relationships, and improve overall business quality.

Reviewing existing operational controls and processes, to ensure financial crime risks are being adequately managed, identifying weaknesses that may lead to financial loss, regulatory and legal censure and exploitation by fraudsters.

Introducing technology for efficient customer onboarding, to meet AML regulations and improve the customer journey.

Please feel free to contact us for a friendly, no obligation chat to see how we can work in unity, to help you stay safe and secure a successful future for you and your business.